In the rapidly evolving commercial real estate market, staying ahead of trends is not just a competitive advantage—it’s a necessity. At AB&B CRE, data analysis serves as the cornerstone of their strategy, enabling them to navigate market complexities, anticipate opportunities, and deliver exceptional value to stakeholders. By integrating cross-disciplinary expertise in operations, financial modeling, regulatory compliance, and market analysis, AB&B is redefining how commercial real estate firms leverage analytics for strategic decision-making.

Navigating an Evolving Market with Precision

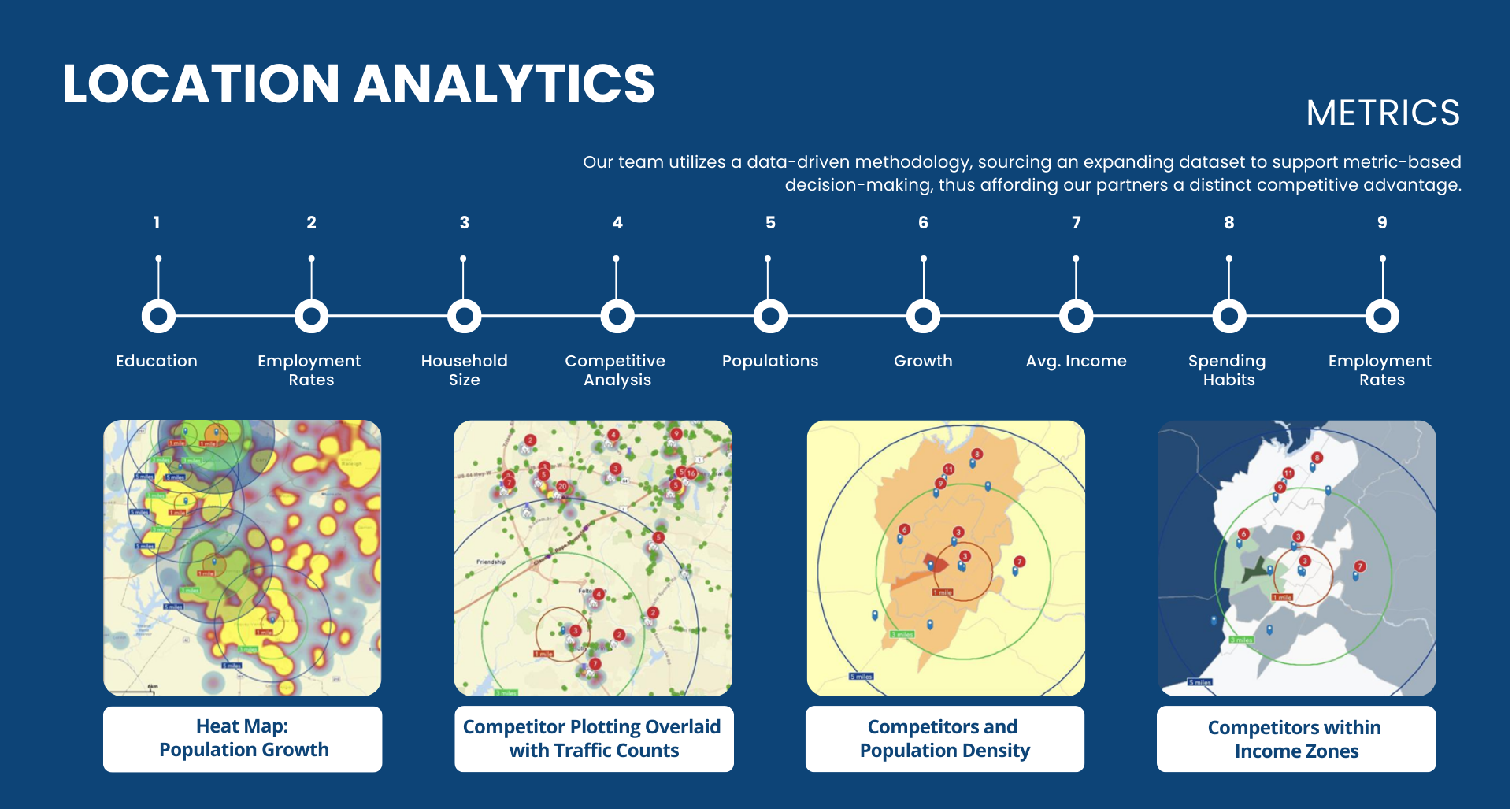

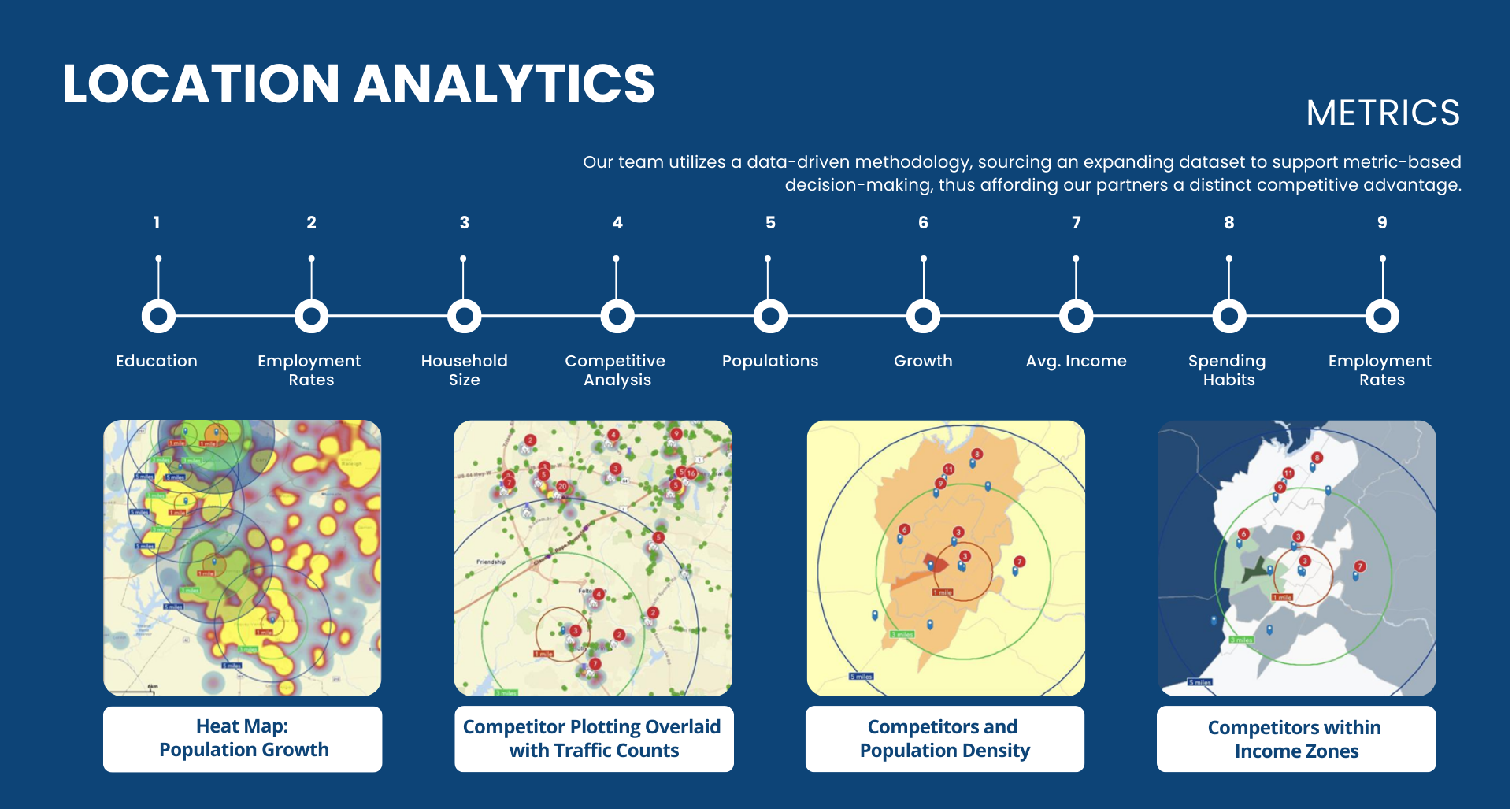

The commercial real estate landscape is shifting. Economic uncertainties, fluctuating interest rates, and increased competition for undervalued properties require companies to operate with precision. AB&B’s team employs a data-driven approach to stay ahead. By proactively analyzing key metrics like occupancy trends, market demographics, and financing structures, they make informed decisions that align with long-term growth objectives.

“Our ability to utilize data as a predictive tool allows us to anticipate shifts in the market,” says Jimmy Ricard, COO. “Whether it’s identifying underperforming assets ripe for repositioning or understanding how macroeconomic factors impact financing options, our strategy is always forward-looking.”

Financial Planning Meets Strategic Vision

Leading the charge in financial planning is Gerhard Renner, AB&B’s CFO. His expertise in corporate finance and his meticulous approach to forecasting ensure that every project is backed by rigorous analysis and realistic projections. Gerhard’s financial acumen enables the team to structure investments strategically, ensuring returns meet or exceed expectations.

“Data analysis isn’t just about numbers; it’s about context,” Gerhard explains. “We’re not only looking at past performance but using predictive models to understand what’s coming next. This approach helps us de-risk investments while maximizing returns.”

AB&B’s proprietary models provide detailed insights into development projects, from construction budgets to operational efficiencies. These tools empower the team to communicate with lenders and investors with confidence, ensuring transparency and trust in every deal.

Strategic Execution: Insights from the Beehive

AB&B’s Beehive philosophy fosters collaboration, creating a culture where every team member’s expertise contributes to the company’s success. Jimmy’s operational oversight ensures streamlined processes and clear communication across departments. Gerhard’s strategic financial planning aligns investment goals with actionable insights. Meanwhile, team members like Allen and Ciaran focus on the granular details such as ensuring accuracy in all assumptions, from tenant and property performance metrics to regulatory compliance, turning raw data into actionable strategies.

“Every number tells a story, and every story has a purpose,” says Jimmy. “At AB&B, we’re not just analyzing data; we’re shaping the future of commercial real estate.”

The AB&B Advantage: A Unified Approach

AB&B’s success lies in its ability to connect data-driven insights with practical execution. The Beehive philosophy ensures that the collective expertise of the team informs strategic decisions, creating a unified approach that drives innovation and growth. Whether analyzing market opportunities, optimizing operational efficiencies, or structuring financial plans, AB&B’s collaborative culture sets them apart in the industry.

Looking Ahead

As the Triangle, NC region continues to grow and evolve, AB&B remains poised to lead. Their robust data analysis capabilities enable them to tackle challenges, seize opportunities, and deliver unmatched value to stakeholders.

By leveraging data as a strategic asset, AB&B CRE is setting the standard for innovation and excellence in commercial real estate. Their proactive approach ensures they remain not only relevant but indispensable in an ever-changing market.